Risk Disclosure

Learn more about your portfolio risks.

Understanding Risk

All investments contain an element of risk and it is important for investors to have an understanding and awareness of the risks associated with any investment they may hold or that is being recommended. Risk can be defined as the potential for an investment to achieve a return lower than was expected at the time of investing. This ‘unexpected return’ can be due to any number of variables, such as market changes, adverse economic conditions or other specific risks.

Past investment results are not an indication to future performance.

The level of risk that investors are comfortable with varies greatly from person to person. It is critical that any recommendations made are consistent with the level of risk that is acceptable to them. An investor needs to have a comprehensive understanding of risk to enable them to make informed decisions about their investment portfolios. Risk to some may mean the possibility of losing a portion of their capital, while for others it may mean the possibility that their investment doesn’t generate sufficient income for them to live on.

Risk and uncertainty cannot be eliminated entirely; however they can be measured and managed within your portfolio. The key is to determine the appropriate level of risk for you. Taking on greater uncertainty and short-term risk may be necessary for you to gain the long-term returns needed to achieve your objectives. Any assessment of risk appetite should be in the context of your objectives and the timeframe in which you wish to achieve your objectives.

An integral part of the ongoing management of investment risk is to have your financial adviser review your risk profile and current situation to assist in making investment decisions.

Asset Classes

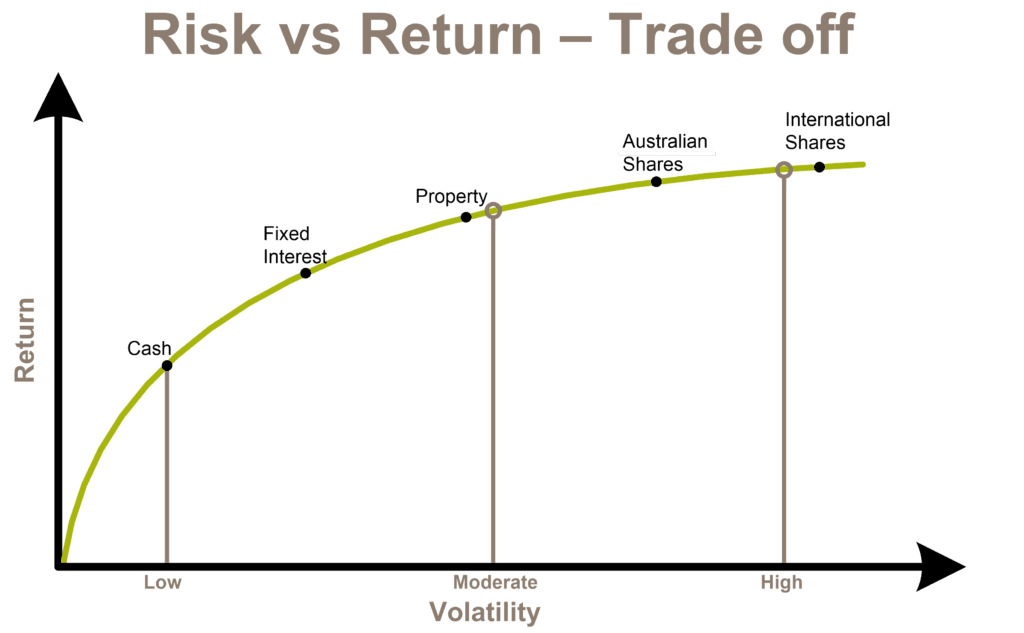

The major asset classes of cash, fixed interest, shares (Australian & International) and property all have unique risk characteristics based on the level of price volatility or instability. For example, cash and fixed interest investments are less exposed to market price fluctuations than investments in shares or property and therefore have a lower risk profile. It is important to understand that, in general, the more volatile an investment is, the higher the potential returns from that investment. Conversely, while an investment may have higher potential returns, there is also a higher chance that the investment will fail to deliver an expected return and may decline in value.

Risk (often referred to as Volatility) is a term that refers to the unpredictable upward and downward shifts of investment values over a period of time. The greater the volatility of an investment, the more often its value shifts. Risk and Return are closely related. In general, the higher the degree of risk associated with an investment, the higher the return required by investors to accept that level of risk. Low risk investments, such as cash, offer relatively low returns as a reflection of their greater security and are better suited to risk-adverse investors. This is called the risk versus return trade-off, and is used as a guide in selecting the appropriate asset allocation for your portfolio.

This relationship between long term (i.e. 7 years or more) risk and return in different asset classes is illustrated in the following graph:

When investing it is important to understand that all investments have associated risks. For example, Government Bonds, which are often described as secure and ‘risk-free’, contain risk for the investor. For example, consider an investor who purchases a 10-year $10,000 government bond, yielding 6.5% per annum (i.e. $650 per annum interest). Next year, the investor finds he needs the funds invested and decides to sell the bond. Since the initial purchase, the yield on the 10-year bond has risen to 9.5% per annum. Under these circumstances, a new investor could now buy a government bond returning $650 per annum for $6,842 instead of $10,000 previously. This reduces the value of the bond to approximately $8,240, which represents a loss of 17.6% from the so-called ’risk-free’ investment. If the investor was able to wait the full 10-year term of the bond, he would receive the full $10,000 (plus the $650 each year).

Any investment decision you make means taking a risk of some sort. The decision will directly relate to the amount of money you invest, your circumstances at the time and your needs for the future. If you have a better understanding of risk, you can make a more informed investment decision, accepting some risks and rejecting others. The important point is that you understand the relationship between risk and return, particularly over your investment timeframe.

The following is a summary of some of the risks that can affect investors:

Risk | Explanation |

Inflation risk | The real purchasing power of your money may not keep pace with inflation. Inflation is an important consideration for all investors. If the after-tax return on your investments is less than the rate of inflation, then the real value of your money will decline. |

Interest rate risk | For investors relying on fixed-rate investments, maturing money may have to be reinvested at a significantly lower rate. |

Market risk | Movements in the market mean the value of your investment can go down as well as up, sometimes suddenly. Different types of investments experience different levels of volatility. Volatility becomes a problem if you do not have the timeframe to withstand the periods when your investment value has decreased significantly. It is important to remember that markets go through regular ups and downs and that capital losses can occur if investments are redeemed when markets are down.While it is tempting to sell out of an investment after its value has fallen, history has taught us that investors who stick with their strategy generally go on to recover and prosper. |

Risk of not diversifying | All your capital will be affected if your single investment performs poorly. Diversification means spreading your money across different investments to reduce risk. The right asset allocation is an important driver for the long-term returns of your portfolio. |

Market timing risk | Anticipating market rises and falls can be extremely difficult because no two economic cycles are the same. Market timing is not a good long-term approach and it tends to result in an overall poor performance and high transaction costs.A sensibly balanced diversified portfolio will generally outperform a continually changing portfolio. |

Credit risk | This applies to debt type investments such as term deposits and debentures. The institution you have invested with may not be able to make the required interest payments or repay your capital. |

Liquidity risk | You may not be able to access your money quickly, or without cost, when it is required. |

Legislative risk | Your investment strategy could be affected by changes in the current laws and regulations. |

Mismatch risk | The investment you choose may not be suitable for your objectives and situation. A perfectly sound investment choice for you now may not be the best choice at a future time. |

Risk and volatility can be managed or minimised in various ways. A particularly risk-averse investor may wish to invest only in cash or fixed interest and this may seem appropriate. It must be remembered, however, that a strategy of this type may reduce volatility but is risky in its own right as the investor is foregoing the potential for higher returns in the portfolio.

The most widely recognised method for managing portfolio risk is through diversification of investments and investment management. To minimise the volatility and risk of your investment portfolio, it is prudent to ensure that it is sufficiently diversified against over-exposure to a single asset, asset class, geographical region or investment manager. This is because no one asset, asset class, geographical region or investment manager provides the best performance over all time periods. A range of investments should reduce the risk of the portfolio experiencing drops in performance across the board simultaneously, as one asset class or manager may perform well to counter the poor performance of another.

Diversification Across Asset Classes

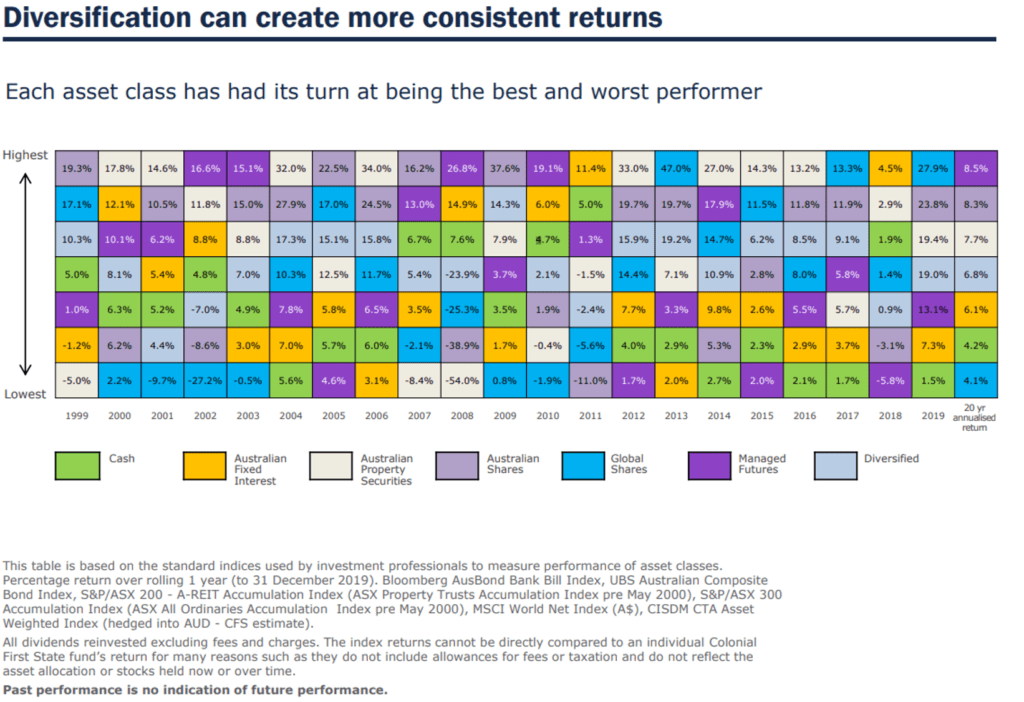

Historically, no single asset class has consistently outperformed all others every year (see chart below). So by investing across the main asset classes; shares, property, fixed interest and cash, investors may be able to reduce the volatility of their portfolio return. If any investment sector is particularly volatile or performing poorly, other investment sectors may compensate.

A well-diversified investment portfolio would include exposure to the four major asset classes. However, diversification can be further achieved within each asset class. For example, the Australian share market has many sectors, including banking, resources, manufacturing, technology and media. Spreading investments across sectors can reduce the volatility of returns as each industry’s performance will differ, depending upon prevailing market conditions.

This can be illustrated in the table below:

Diversification Across Investment Management Styles

Investment management styles tend to excel at different times under changing economic and market conditions. Diversification of investment managers lowers the risk profile of your portfolio by providing exposure to different management styles. For example, one manager may have a buy and hold approach whilst another may adopt an active trading strategy. Managers may have preferences for shares with certain characteristics. For example, targeting those that produce franked dividends or those likely to produce capital growth.

Each of these styles can impact your portfolio risk and return. By combining a range of investment managers with complementary investment styles, you are able to reduce the bias to any one style and reduce the impact of any one investment under-performing over a period of time, in comparison to other investments.

Diversification Across Markets And Regions

It is important to spread your exposure within each asset class across a wide range of countries and currencies. This global approach ensures that your investment is not narrowly concentrated in a particular region or industry and helps to reduce the impact of a regional or industry downturn. There is no right or wrong mix of investments or management styles for a given portfolio. The mix depends entirely on your risk profile and your individual objectives for the portfolio. Some investors may be comfortable with investing entirely in the share market whilst others may seek limited share market exposure. Before accepting and implementing any investment recommendation, you should be comfortable that the benefits of diversification have been considered and that, where appropriate, a balanced well-diversified portfolio is structured to meet your objectives.

Non-Resident Investors

Non-residents are taxed, in Australia, on income that is sourced within Australia. Different types of income have different tax rates. Withholding tax is a final tax and therefore, dividends and interest income will not be subject to any further Australian taxation. Franked dividends are also not subject to any further taxation. Non-residents are only subject to Capital Gains Tax (CGT) in relation to certain assets.

Taxable Australian Real Property

If you receive rental income from an Australian property, you must declare the income in an Australian tax return and will be taxed at the non-resident tax rates. If you sell an Australian property, you must report the sale in an Australian tax return and pay capital gains tax on any profit.

Fixed Interest and Dividends from Direct Shares

Non-residents from countries who have double tax agreements with Australia will pay 10% withholding tax on interest, 15% withholding tax on unfranked dividends, and no withholding tax on fully franked dividends. Countries that do not hold a double tax agreement with Australia will pay 30% withholding tax on unfranked dividends.

Dividends & Interest Components of Distributions from Managed Funds

A managed fund may be required to withhold an amount from a payment of its Australian sourced net income (other than dividends, interest, and royalties) if the payment is made to a recipient whose address, or place for payment, is outside Australia. Fund payments to non-residents are subject to a final withholding tax of:

15% where the payment is made to a recipient of a country that has an exchange of information agreement with Australia.

30% where the payment is made to a recipient of a country that does not have an exchange of information agreement with Australia.

What are the Capital Gains Tax Implications on becoming an Australian Resident?

When a non-resident becomes an Australian resident, special cost base and acquisition rules apply in relation to Capital Gains Tax. The special acquisition rule treats the taxpayer as having acquired the asset, at market value, at the time of becoming a resident. Therefore, a non-resident who became a resident after investing in a unit trust, which increased in value, would be advantaged. However, this does not apply to pre-CGT assets or assets that have the necessary connection with Australia.

Capital Gains Tax on Disposal of Managed Funds?

When a non-resident disposes of units in a resident property unit trust (managed investment), which is a resident for CGT purposes, and where the taxpayer beneficially owns less than 10%, the non-resident will not be liable for Capital Gains Tax.

Is a Refund for Tax Paid at Non-Resident Rates Allowed?

Distributions that have been subject to non-resident tax can be included in an Australian tax return. In the case where a non-resident has losses, income can be offset against the loss, which will result in a tax refund.

Negative Gearing Risks

The specific risks that are involved in negative gearing are:

- Fluctuations in interest rates. If income from investments does not change but interest rates on borrowed funds increase, then an investor will incur additional interest costs which will need to be covered from other sources.

- Fluctuations in the level of income received from investments, which may result in a reduction in cash flow and a reduced ability to service the interest costs.

- Fluctuations in the capital value of the investments can occur and consequently, the capital value of the initial investment can never be guaranteed.

The market price of securities can move down as well as up and, if it falls, a margin call on the investment may be made. This means that the investor would need to repay part of the borrowed funds or lodge additional security against the loan. The loan plus the interest repayments must be made in full even if the value of the investment falls. Just as potential gains can be increased by a geared investment, capital losses are also multiplied if returns from an investment are negative.

Margin Lending

Under Margin lending, the loan is secured against shares and property trusts listed on a stock exchange as well as unlisted managed funds. Some of these will be existing investments which represent the borrower’s equity with the balance being new investments purchased with proceeds of the loan.

Margin lending is offered by many banks as well as other finance providers including stock brokers.

The lender provides a list of the specific securities that it will accept, and nominates a percentage of the market value for each security, which is the maximum amount that it will loan against that security. The interest rate is normally higher for a margin loan than for a property loan, however establishment costs are generally lower. A margin lending facility needs to be supported by the investor’s cash flow during times when the value of the investment falls. If the value falls, you may be required to invest further capital or reduce the loan balance – this is known as a margin call.

Margin Calls

The borrower must satisfy a margin call (usually within 24 hours) or the lender can sell a sufficient quantity of the assets lodged as security to satisfy the call. A margin call can be satisfied by:

– Lodging further assets as security;

– Lodging cash or other funds to reduce the loan; and/or

– Selling assets and using the proceeds to reduce the loan.

Security for Loans

The margin lender provides a maximum lending percentage that they are willing to lend for each individual investment and the average of these provides a maximum allowable borrowing on the loan.

If the amount of the loan reaches this borrowing limit there is normally a ‘percentage buffer’ before a margin call is requested. The actual percentages of your loan will be calculated at the time of your specific investment.

Maximum Gears Levels

To reduce the risk of a margin call we recommend that when establishing a margin loan it should have no more than a 50% gearing ratio.